Minuto a minuto: Desplome financiero mundial

El mayor desplome de las bolsas chinas desde 2007 ha provocado este lunes una ola de caídas en los mercados de todo el mundo. Países asiáticos, europeos y de Oriente Medios experimentaron algunas de las mayores caídas en los últimos años, mientras que el precio de petróleo vuelve a marcar su cota mínima. Siga minuto a minuto los hechos más importantes del desplome bursátil a escala mundial.

24 de agosto

14:07 GMT La Bolsa de Nueva York ha informado que suspenderá las operaciones durante 15 minutos en el caso de que el índice Standard & Poor’s 500 caiga más de un 7%, informa Bloomberg. Al mismo tiempo, si la caída alcanzara un 20% la Bolsa cerrará en cualquier momento de la sesión para el resto de la jornada.

14.00 GMT Las bolsas de valores de EE.UU. también iniciaron hoy sus labores con una fuerte caída, siguiendo así la tendencia de los mercados mundiales que se han visto afectados por el desplome de China. Tras la campana de apertura en Wall Street el Dow Jones había caído en picado 1.000 puntos en los primeros minutos de intercambio. El Nasdaq perdió un 8% y el S&P 500, un 4,95%.

13.31 GMT Queda menos de una hora para la apertura de las bolsas estadounidenses. Los inversores esperan una caída de los índices norteamericanos debido al pánico que reina en las bolsas mundiales.

12.08 GMT El economista Eñaut Apaolaza sostiene que los más perjudicados por esta situación] serán los países con las economías endeudadas. “Me refiero sobre todo a las economías europeas y a la estadounidense”, indica.

11.53 GMT El índice FTSE 100, integrado por los 100 principales valores de la Bolsa de Londres, se situó este lunes por debajo de los 6.000 puntos (5.914 puntos). Su caída de un 4,5% lo sitúa en su nivel más bajo desde enero de 2013, según ‘The Guardian’. Los mercados europeos siguen cayendo debido a las predicciones de que las bolsas norteamericanas también sufran un impacto negativo en el momento de su apertura.

10.00 GMT El Ibex 35, el principal índice bursátil de la bolsa española, abrió este lunes con una caída del 3,2%. A su vez, las bolsas en Italia, Francia, Reino Unido y Alemania perdieron de media un 3%.

09.15 GMT Los mercados de valores rusos tambien registran pérdidas: El RTS Index cae un 5%, mientras que el MICEX, pierde un 1,74%. La cotización del rublo en relación al dólar y el euro cayó hasta el nivel que registró a principios de febrero.

09.09 GMT El barril de crudo Brent alcanzó su precio más bajo en seis años situándose por debajo de los 44 dólares, ante lo que reaccionaron inmediatamente las bolsas de Oriente Medio.

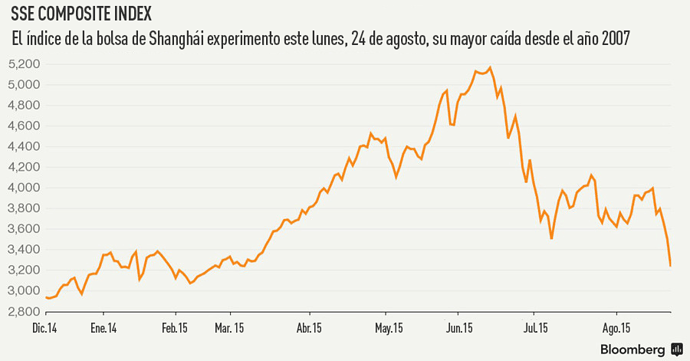

06.28 GMT El índice de la bolsa de Shanghái, SSE Composite Index, experimentó este lunes, 24 de agosto, su mayor caída desde el año 2007, un 8,9%. El índice Hang Seng de Hong Kong perdió un 5,5%.

Minuto a minuto: Desplome financiero mundial - RT

La peor caída bursátil desde 2008: Desplome en las bolsas de EE.UU. ‘contagiada’ por la de China

Las bolsas de valores de EE.UU. iniciaron hoy sus labores con un fuerte caída, siguiendo así la tendencia de los mercados mundiales que se han visto afectados por el desplome de China.

[SIZE=“3”]Blood On The Streets: Down Dumps 1000 Points At Open, Biggest Drop Since Lehman[/SIZE]

[SIZE=“4”]Panic!! All Major US Equity Indices Halted[/SIZE]

Nasdaq was the first to be halted at 0758ET.

The Dow is now down 850 points from Friday’s close and halted…

The S&P 500 Futures is halted for the first time in history

http://www.zerohedge.com/news/2015-08-24/panic-all-major-us-equity-indices-halted

[SIZE=“3”] Why The Bear Of 2015 Is Different From The Bear Of 2008 [/SIZE]

Are there any conditions now that are actually better than those of 2008?

It’s tempting to see similarities in last week’s global stock market mini-crash and the monumental meltdown that almost took down the Global Financial System in 2008-2009. The dizzying drop invites comparison to the last Bear Market that took the S&P 500 from 1,565 in October 2007 to 667 on March 9, 2009.

But this Bear is beginning in circumstances quite different from 2007-08. Let’s list a few of the differences:

1. Then: Markets and central banks feared inflation, as WTIC oil had hit $133 per barrel in the summer of 2008.

Now: As oil tests the $40/barrel level, markets and central banks fear deflation.

2. Then: China had a relatively modest $7 trillion in total debt, considerably less than 100% of GDP.

now: China’s debt has quadrupled from $7 trillion in 2007 to $28 trillion as of mid-2014, an astonishing 282% of gross domestic product (GDP)

3. Then: Central banks had a full toolbox of unprecedented monetary surprises to unleash on the market: TARP, TARF, BARF (OK, that one is made up) rescue packages and credit guarantees, quantitative easing (QE), zero interest rate policy (ZIRP) and direct purchases of mortgages, to name just the top few.

Now: The central bank toolbox is empty: every tool has already been deployed on an unprecedented scale. Every potential new program is simply a retread of QE, yield curve bending, asset purchases, etc.–the same old bag of tricks.

4. Then: Central banks had a relatively clean slate to work with. Interventions in the market and economy were limited to suppressing interest rates in the post-dot-com meltdown era.

Now: Central banks have never stopped intervening since 2008. The market is in effect a reflection of 6+ years of unprecedented central bank interventions. Rather than a clean slate, central banks face a global marketplace that is dominated by incentives to speculate with leveraged/borrowed money established by 6 years of central bank policies.

5. Then: Interest rates had rebounded from the post-dot-com lows in 2003. The Fed Funds rate in 2006-07 was above 5%, and the Prime Lending Rate exceeded 8%.

Now: The Fed Funds Rate has been screwed down to .25% for 6+ years–an unprecedented period of near-zero interest rates.

6. Then: The average 30-year mortgage rate was above 6% from October 2005 to November 2008.

Now: Mortgage rates have been under 4% in 2015.

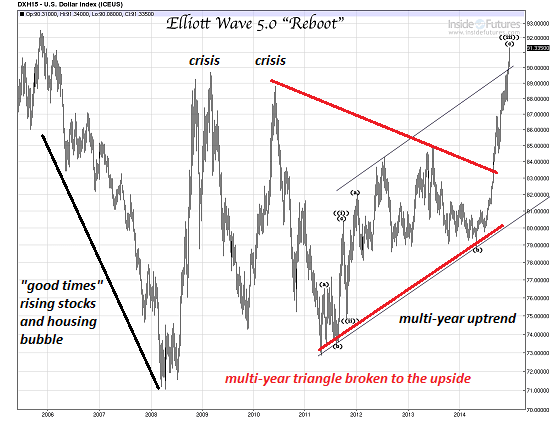

7. Then: The U.S. dollar only soared in financial crises as capital flowed to safe havens in late 2008-early 2009 and again in 2010.

Now: The U.S. dollar began a 20% increase in mid-2014, in the midst of what was generally perceived as a solid global expansion

8. Then: The U.S. dollar fell sharply from 2006 to 2008, and again in 2010 to 2011, boosting the overseas profits of U.S. corporations that account for 40% to 50% of total multinational corporate profits.

Now: The rising dollar has crushed the overseas profits of U.S. corporations. The soaring USD has also crushed emerging market currencies and stock markets, and forced China to devalue its currency, the the RMB (yuan)–a devaluation that triggered the current global meltdown in stocks.

9. Then: The global boom 2003-2008 was widely viewed as a tide that raised all ships.

Now: Central bank policies are recognized as engines of inequality that have widened income and wealth inequality for 6+ years.

Are there any conditions now that are actually better than those of 2008? Or are conditions now less resilient, more fragile and more dependent on unprecedented central bank interventions?

Why The Bear Of 2015 Is Different From The Bear Of 2008 | Zero Hedge

[SIZE=“3”]NYSE Invokes Rule 48 (Once Again) To Pre-Empt Panic-Selling Open[/SIZE]

The status quo must be maintained…

NYSE granting "triple width opening quote relief in all option classes for August 24, 2015", Invokes Rule 48

The last time this was invoked was in Jan 2015 (during the blizzard), in June 2012 (amid a dramatic drop in pre-open futures) and in Sept 2011 amid the chaotic 400-point swings in The Dow. Funny they do not use this “Rule” when futures indicate massive upside opens?[/I]

Via NYSE:

Rule 48. Exemptive Relief — Extreme Market Volatility Condition

(a) In the event that extremely high market volatility is likely to have a Floor-wide impact on the ability of DMMs to arrange for the fair and orderly opening, reopening following a market-wide halt of trading at the Exchange, or closing of trading at the Exchange and that absent relief, the operation of the Exchange is likely to be impaired, a qualified Exchange officer may declare an extreme market volatility condition with respect to trading on or through the facilities of the Exchange.

(b) In the event that an extreme market volatility condition is declared with respect to trading on or through the facilities of the Exchange, a qualified Exchange officer shall be empowered to temporarily suspend at the opening of trading or reopening of trading following a market-wide trading halt: (i) the need for prior Floor Official or prior NYSE Floor operations approval to open or reopen a security at the Exchange (Rules 123D(1) and 79A.30); and/or (ii) applicable requirements to make pre-opening indications in a security (Rules 15 and 123D(1)).

© A suspension under section (b) of this Rule is subject to the following provisions:

(1) (A) Before declaring an extreme market volatility condition, the qualified Exchange officer shall consider the facts and circumstances that are likely to have Floor-wide impact for a particular trading session, including volatility in the previous day’s trading session, trading in foreign markets before the open, substantial activity in the futures market before the open, the volume of pre-opening indications of interest, evidence of pre-opening significant order imbalances across the market, government announcements, news and corporate events, and such other market conditions that could impact Floor-wide trading conditions.

(B) Such review shall be undertaken in consultation with relevant officers of NYSE Market and NYSE Regulation, as appropriate. Following the review, the qualified Exchange officer or his or her designee shall document the basis for declaring an extreme market volatility condition.

(2) The qualified Exchange officer will, as promptly as practicable in the circumstances, inform the Securities and Exchange Commission staff that an extreme market volatility condition has been declared, the basis for such declaration, and what relief has been granted.

(3) An extreme market volatility condition may only be declared before the scheduled opening or reopening following a market-wide halt of securities at the Exchange.

(4) A declaration of an extreme market volatility condition shall be in effect only for the particular opening or reopening for the trading session on the particular day that the extreme market volatility condition is determined to exist. The Exchange may declare a separate extreme market volatility condition on subsequent days subject to sections (b)(1) through (b)(3) above.

(5) A declaration of extreme market volatility shall not relieve DMMs from the obligation to make pre-opening indications in situations where the opening of a security is delayed for reasons unrelated to the extreme market volatility condition.

(d) For purposes of this Rule, a “qualified Exchange officer” means the Chief Executive Officer of ICE, or his or her designee, or the Chief Executive Officer of NYSE Regulation, Inc., or his or her designee.

As WSJ explains, basically it means the designated market makers “will not have to disseminate price indications before the bell, making it easier and faster to open stocks.

The rule was approved by the Securities and Exchange Commission on Dec. 6, 2007 and has been used rarely since then.

[SIZE=“3”]Deutsche Bank Sums It Up “The Fragility Of This Artificially Manipulated Financial System Was Finally Exposed”[/SIZE]

Today’s dose of vile tinfoil hattery magick comes straight from the bank with the cool $55 trillion or so in derivatives, Deutsche Bank:

The fragility of this artificially manipulated financial system was exposed over the last couple of days of last week. It all ended with the S&P 500 falling -3.19% on Friday - its worst day since November 9th 2011.

* * *

We've long felt that the only thing preventing another financial crisis has been extraordinary central bank liquidity and general interventions from the global authorities which we still expect to continue for a long while yet. So when policy changes, risks arise. The genesis of this recent sell-off has been the threat of the Fed raising rates next month, but China's confrontational move two weeks ago and the subsequent knock-on through EM have accelerated us towards something more serious. We always thought something would get in the way of the Fed raising rates in September and we're perhaps seeing this now. With 24 days to go until we find out, the probability of a hike has gone down to 34% from a 54% recent peak on August 9th. Having said we always thought something would come along to derail a Fed rate hike we probably should have gone underweight credit.[B] [I]However with trading liquidity poor and with a reasonably high desire to be long amongst investors there has to be a big move to justify the change in stance[/B]. Also with a strong possibility that the Fed will relent and that China could add more stimulus soon, there may be a small window to be short European credit. So at the moment this could be a dangerous time to sell. [B]However if it wasn't for expected intervention and extraordinary central bank policy we would be very bearish as the global financial system remains an artificial construct reliant on the largesse of the authorities.[/B][/I]

So 6 years after we first said what at the time was seen as heretical “tinfoil” conspiracy theory, now everyone admits it. Almost time to take a vacation maybe.

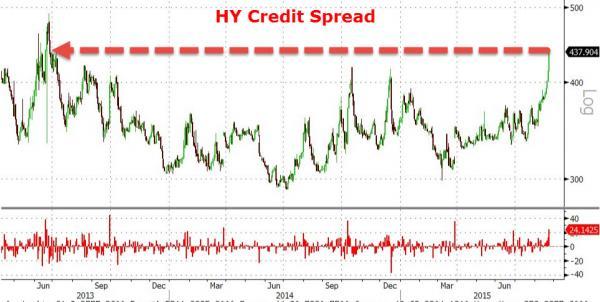

[SIZE=“3”]High Yield Credit Risk Explodes To Its Highest Since June 2013[/SIZE]

[SIZE=“3”]Nasdaq Futures Halted Below 4,000 After Hitting Circuit Breaker Down 5%[/SIZE]

NASDAQ 100 SEPTEMBER FUTURES HIT CIRCUIT BREAKER, HALTED - RTRS

Nasdaq Futures below 4,000!

The Nasdaq is now notably underwater for 2015, trading at levels first seen over a year ago.

Nasdaq is halted for the 3rd time…

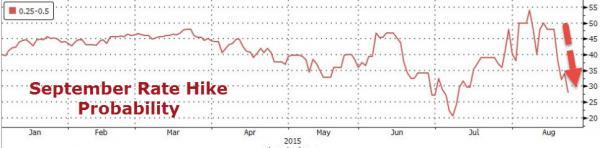

[SIZE=“3”]September Rate-Hike Probability Crashes To Just 28%[/SIZE]

The message from the market to The Fed…

“Hike” and it’s all over…

[SIZE=“3”]Dow Futures Down 2500 From Highs, Crashing To 2013 Levels[/SIZE]

Dow futures are now well below the 16,000 level - down a stunning 2500 points from the May highs. The Dow has given up all its gain since December 2013…

[SIZE=“3”]iCrash? AAPL Down 6% In Pre-Open, Breaks Below “No Brainer” $100 Level[/SIZE]

iCrash? AAPL Down 6% In Pre-Open, Breaks Below “No Brainer” $100 Level | Zero Hedge

[SIZE=“3”]Brent Oil Drops Below $45 First Time Since 2009 as Glut Persists[/SIZE]

[I]Brent crude fell below $45 a barrel for the first time in more than six years amid signs a global glut will persist as Iran pledged to boost production and U.S. drilling activity sustained an increase.

Brent for October settlement dropped as much as 1.7 percent to $44.69 a barrel on the London-based ICE Futures Europe exchange and traded at $44.82 at 9:39 a.m. Singapore time. Prices retreated for a fourth day, extending declines from the lowest close since March 2009. Iran’s oil minister said the country will expand output “at any cost” while in the U.S., the number of active rigs rose for the seventh time in eight weeks.[/I]

Brent Crude Falls Below $45 for First Time Since 2009 on Surplus - Bloomberg Business

[SIZE=“3”]Deutsche Bank Says Rout ‘Very Serious’ as Growth Outlook Dims[/SIZE]

[I]

The meltdown in global markets is “very serious” as it will weaken prospects for growth worldwide, said Henning Gebhardt, global head of equities at Deutsche Bank AG’s asset and wealth management unit.

“We are expecting some adjustments for the global economic outlook – especially triggered by weaker growth in emerging markets,” Gebhardt said in an e-mailed response to questions on Monday in Frankfurt. “The low oil price and the changed economic outlook will create another round of global earnings cuts.”

Global stocks have lost $5 trillion since China unexpectedly devalued the yuan on Aug. 11, with investors spooked by signs of further weakening in the world’s second-largest economy. The rout is raising doubt about the ability of the global economy to withstand a eventual liftoff in U.S. interest rates this year.

Developing economies bore the brunt of the sell-off, with the MSCI Emerging Markets Index sliding 4.4 percent at 10:42 a.m in Frankfurt, headed for the biggest one-day drop since September 2011.

Brent crude tumbled through $45 a barrel and oil in New York traded below $40. Oil at that price will have a negative effect on some emerging economies, according to Gebhardt, who helps manage the 1.14 trillion euros ($1.31 trillion) Deutsche Bank invests for clients.

Still, stocks remain attractive as valuations have fallen, he said. “We cannot exclude that the selling pressure will last for a while, but would add to positions, especially in dividend stocks.”[/I]

Deutsche Bank Says Rout ‘Very Serious’ as Growth Outlook Dims - Bloomberg Business

[SIZE=“3”]The Fed Is Looking at a Very Different Dollar Than Wall Street[/SIZE]

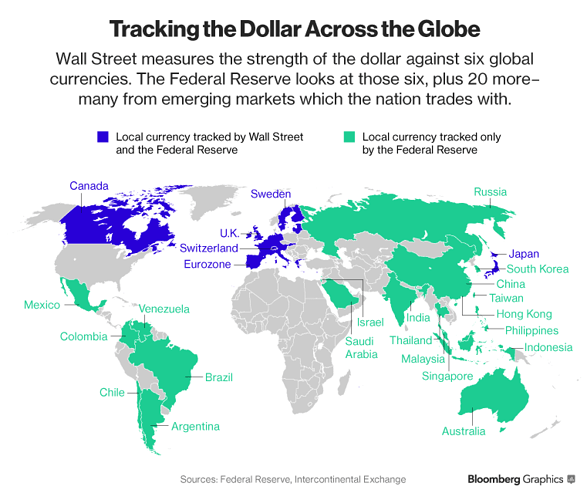

By many popular measures, the dollar has traded sideways for the last six months. Then there’s the Federal Reserve’s measure.

The greenback is surging, according to an index the Fed created to track the U.S. currency versus 26 of the country’s biggest trading partners. It’s risen 1.3 percent beyond a 12-year high reached in March, when the central bank fired the first of a series of warnings that a stronger dollar may hurt growth and lower inflation

At a time when the Fed’s tightening path has become one of the biggest drivers in the $5.3 trillion-a-day foreign-exchange market, the discrepancy between Wall Street’s view – largely based on the dollar’s performance against the euro and the yen – and that of policy makers may lead to a jolt for investors expecting recent ranges to persist. The rapid trade-weighted appreciation this quarter has come mostly against big exporters such as China and Mexico, and it undercuts the Fed’s goal of quicker inflation. It may trigger further jawboning from officials looking to cool the dollar’s broad gains as the Fed begins raising interest rates for the first time in almost a decade.

The dollar still continues to strengthen on a trade-weighted basis and the Fed definitely takes that into the equation,'' said Brad Bechtel, a managing director at Jefferies Group LLC in New York.The risk is the Fed starts really emphasizing that, and the market would be caught offside.’’

Yuan, Peso

The Fed’s trade-weighted broad dollar index measures the greenback against the currencies of 26 economies according to the size of bilateral trade. China, Mexico and Canada make up 46 percent of the gauge

Meanwhile, most private-sector dollar gauges track a basket of the world’s most liquid, widely used currencies. Intercontinental Exchange Inc.'s U.S. Dollar Index, which serves as the benchmark for various futures and options instruments, has a 58 percent weight to the euro and 14 percent for the yen. It lacks representation from any emerging markets, which account for more than half of the U.S.'s total trade flow.

The two indexes had moved alongside each other until a month ago. The Fed’s broad dollar index surged 3.4 percent this quarter to a 12-year high as China devalued the yuan to support a slowing economy, while a renewed commodities rout undermined Canada’s loonie and the Mexican peso. The ICE dollar gauge dropped 1.9 percent during the same period.

[SIZE=“3”] Measures Matter [/SIZE]

It's important to be mindful of which dollar measures matter, especially if you're looking at it through the Fed's eyes,'' Ellen Zentner, chief U.S. economist at Morgan Stanley, said on Bloomberg Radio. One of the criteria for the Fed to raise rates isa leveling out of the trade-weighted dollar. At the time of the June meeting, they could check off that box. Today, they can’t.’’

Dollar bulls as recently as March were buffeted by unexpected warnings from the central bank. On March 18, a few days after the Fed index rose to the strongest in more than a decade, Chair Janet Yellen said the dollar would be a ``notable drag’’ on growth this year.

The same day, policy makers lowered their forecasts for the fed funds rate by almost half. The ICE dollar index dropped 1.2 percent over the next two weeks.

In the minutes from the Fed’s July meeting released last week, the dollar was mentioned 12 times, as some officials ``continued to see downside risks to inflation from the possibility of further dollar appreciation and declines in commodity prices.’’

[SIZE=“3”]Inflation Detriment[/SIZE]

The dollar’s surge may restrain inflation and limit the Fed’s ability to raise interest rates, punishing the U.S. currency against some major counterparts, according to Nomura Holdings Inc.

In coming months we'll be looking at import price deflation that is the most severe we've had for many years,'' said Jens Nordvig, a managing director of currency research at Nomura.There may be opportunities to fade dollar gains in Group-of-10, where the direction of the Fed really is a key driver.’’

(With assistance from Chloe Whiteaker)

The Fed Is Looking at a Very Different Dollar Than Wall Street - Bloomberg Business