Se pospone:

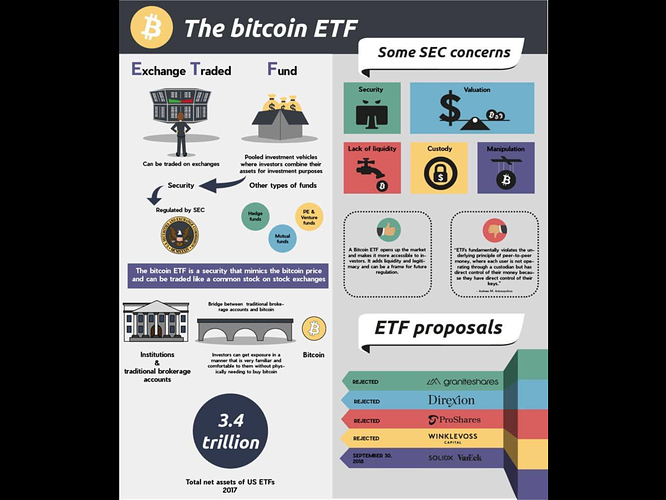

Minutes ago the SEC announced the postponement of a decision to approve or deny the submission of the Bitcoin ETF via VanEck and Solid X. Amongst prognosticators this particular submission stands the best chance of approval – but that approval (or denial will have to wait).

https://www.coindesk.com/sec-seeks-more-input-as-it-weighs-vaneck-solidx-bitcoin-etf/

SEC secretary Brent Fields wrote in the order:

“Institution of such proceedings is appropriate at this time in view of the legal and policy issues raised by the proposed rule change. Institution of proceedings does not indicate that the Commission has reached any conclusions with respect to any of the issues involved. Rather, as described below, the Commission seeks and encourages interested persons to provide comments on the proposed rule change.”

La SEC ahora está repartida en 2 comisionistas a favor y 2 comisionistas en contra… cuanto más tiempo pase hasta su aprobación en busca de pruebas de solidez y comentarios de usuarios, más aumentan las probabilidades de que sea aceptado (con la fecha límite en febrero).

Esta dentro de los cálculos de los que conocen los entresijos del sistema que todo se alargará hasta febrero, a partir de ahí con los wallet bien llenos darán el pistoletazo de salida…

Igual me equivoque mucho, pero por cómo han redactado el comunicado parece que quieran infundir optimismo en cuanto a su aprobación… tal vez febrero no sea el inicio de un ciclo sino el fin de otro?

muy bien visto, si señor. Lo comprobaremos pronto si le dan el pepinazo arriba para romper el triángulo.

No entendí lo que insinuas. Te refieres a que pueden no aprobarlo y seria el fin de un ciclo alcista? De ser así, un rompimiento del triangulo para arriba significaria distribucion y para abajo acumulación?

Estaba divagando, hoy por hoy lo que es seguro es que mucha gente esperaba un desplome si el ETF no era aprobado en septiembre y de momento estamos subiendo en lugar de bajar

Creeis que esta noticia ha dado el pistoletazo de salida? Es muy curioso porque en las anteriores negativas de los ETF’s de este verano al momento el desplome fue bastante grande…

Nose que pensar…

El pistoletazo de salida lo dio ripple con sus noticias, todo lo demás ha venido detrás, esta vez no ha sido Bitcoin la que ha tirado del carro…

Te habrás quedado a gusto con semejante perla

On January 5, 2018, Cboe BZX Exchange, Inc. (“BZX”) filed with the Securities and Exchange Commission (“Commission”), pursuant to Section 19(b)(1) of the Securities Exchange Act of 1934 (“Exchange Act”) 1and Rule 19b-4 thereunder, 2 a proposed rule change to list and trade shares of the GraniteShares Bitcoin ETF and the GraniteShares Short Bitcoin ETF issued by the GraniteShares ETP Trust under BZX Rule 14.11(f)(4). 3The proposed rule change was published for comment in the Federal Register on January 18, 2018. 4 On February 22, 2018, pursuant to Section 19(b)(2) of the Exchange Act, the Commission designated a longer period within which to approve the proposed rule change, disapprove the proposed rule change, or institute proceedings to determine whether to approve or disapprove the proposed rule change. 5On April 5, 2018, the Commission instituted proceedings under Section 19(b)(2)(B) of the Exchange Act the proposed rule change. 6to determine whether to approve or disapprove 7On June 28, 2018, the Commission extended the period for consideration of the proposed rule change to September 15, 2018. 8On August 21, 2018, CboeBZX filed Amendment No. 1 to the proposed rule change, stating that it was amending and replacing in its entirety the proposal as originally filed on January 5, 2018. On August 22, 2018, CboeBZX filed Amendment No. 2 to the proposed rule change, stating that it was amending and replacing in its entirety Amendment No. 1 to the proposed rule change. On August 22, 2018, the Division of Trading and Markets, pursuant to delegated authority, 9issued an order disapproving the proposed rule change. 10 On August 23, 2018, the Secretary of the Commission notified BZX that, pursuant to Commission Rule of Practice 431, the Commission would review the Division’s action pursuant to delegated authority and that the Division’s action pursuant to delegated authority had been automatically stayed. 11 12 On October 4, 2018, the Commission published notice of Amendment No. 2 to the proposed rule change. 13 Accordingly, IT IS ORDERED, pursuant to Commission Rule of Practice 431, that by October 26, 2018, any party or other person may file a statement in support of, or in opposition to, the action made pursuant to delegated authority. It is further ORDERED that the order disapproving proposed rule change SR-CboeBZX2018-001 shall remain in effect pending the Commission’s review.

By the Commission.

Eduardo A. Aleman

Assistant Secretary

On December 4, 2017, NYSE Arca Inc. (“NYSE Arca”) filed with the Securities and Exchange Commission (“Commission”), pursuant to Section 19(b)(1) of the Securities Exchange Act (“Exchange Act”) 1and Rule 19b-4 thereunder, 2 a proposed rule change to list and trade shares of the ProShares Bitcoin ETF and the ProShares Short Bitcoin ETF issued by the ProShares Trust II under NYSE Arca Rule 8.200-E, Commentary .02. The proposed rule change was published for comment in the Federal Register on December 26, 2017. 3 On January 30, 2018, pursuant to Section 19(b)(2) of the Exchange Act, 4the Commission designated a longer period within which to approve the proposed rule change, disapprove the proposed rule change, or institute proceedings to determine whether to approve or disapprove the proposed rule change. 5On March 23, 2018, the Commission instituted proceedings under Section 19(b)(2)(B) of the Exchange Act 6to determine whether to approve or disapprove the proposed rule change. 7On June 15, 2018, the Commission extended the period for consideration of the proposed rule change to August 23, 2018. 8 On August 22, 2018, the Division of Trading and Markets, pursuant to delegated authority, 9issued an order disapproving the proposed rule change. 10 On August 23, 2018, the Secretary of the Commission notified NYSEArca that, pursuant to Commission Rule of Practice 431, 11 the Commission would review the Division’s action pursuant to delegated authority and that the Division’s action pursuant to delegated authority had been automatically stayed. 12 Accordingly, IT IS ORDERED, pursuant to Commission Rule of Practice 431, that by October 26, 2018, any party or other person may file a statement in support of, or in opposition to, the action made pursuant to delegated authority. It is further ORDERED that the order disapproving proposed rule change SRNYSEArca-2017-139 shall remain in effect pending the Commission’s review.

By the Commission.

Eduardo A. Aleman

Assistant Secretary

Se piden comentarios a favor o en contra hasta el 26 de Octubre.