@johnlu Si buscas el articulo en google y haces click a la entrada te deja leerlo

Goldman Sachs Group Inc. has dropped out of the R3 CEV LLC blockchain group. The investment bank was one of nine original members of R3, founded in 2014 to explore the use of the distributed database technology in Wall Street infrastructure.

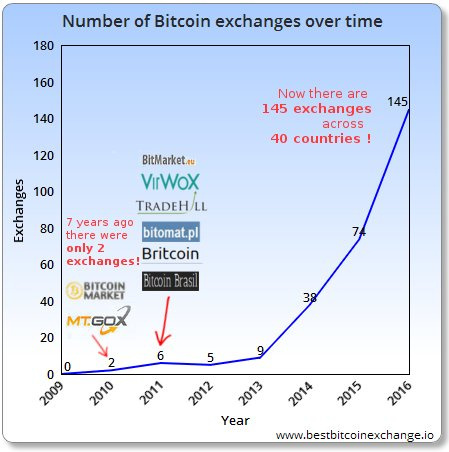

The technology, best known for underpinning the system that trades the virtual currency bitcoin, has garnered increasing attention as a way banks can save billions of dollars and make old-fashioned processes faster and more efficient.

But not all blockchain firms are the same, with different banks backing different ventures to exploit the technology. As of Oct. 31, Goldman let its membership lapse in R3, one of the higher profile efforts, but the firm will continue to work with blockchain technology, a spokeswoman for the investment bank said.

The online distributed ledger is best known for supporting bitcoin digital currency, but banks want to use it to speed up transactions, cut operations costs and better secure the banking and other infrastructure. Blockchain is said to provide an immutable record of transactions and identities. This could eliminate middlemen that perform these services in the existing financial infrastructure.

Turnover is expected, an R3 spokesman said. “Developing technology like this requires dedication and significant resources, and our diverse pool of members all have different capacities and capabilities which naturally change over time,” he said in an email.

As R3 builds blockchain pilots, the group is also seeking equity investment from members in exchange for a stake in proceeds from future technology and products, according to a person familiar with the matter. R3’s 70 members include Bank of America Corp., J.P. Morgan Chase and State Street Corp.

In April, R3 revealed a key early product called Corda, which is a distributed ledger to manage financial contracts. The group has also run a series of blockchain pilots with subsets of its membership, including one where 11 banks traded electronic tokens of value among offices in North America, Europe and Asia to simulate financial transactions over a five-day period. In November, 10 members of R3 tested a Know-Your-Customer system that allows a blockchain ledger to manage and verify parties’ identities.

Goldman has committed to blockchain through investing and through internal development. The bank in 2015 was one of two lead investors in a $50 million funding round for bitcoin startup Circle Internet Financial Ltd. Goldman is also seeking patents on two blockchain-related inventions, for foreign exchange trading and digital currency.

Blockchain has not yet been deployed widely for commercial use, in part because the legalities are unclear. Regulators have not made statements about the requirements blockchain-based systems must meet. Nasdaq Inc.’s Linq exchange for trading shares in private companies is one of the only blockchain-based financial systems in use.

Write to Kim S. Nash at kim.nash@wsj.com

;

;